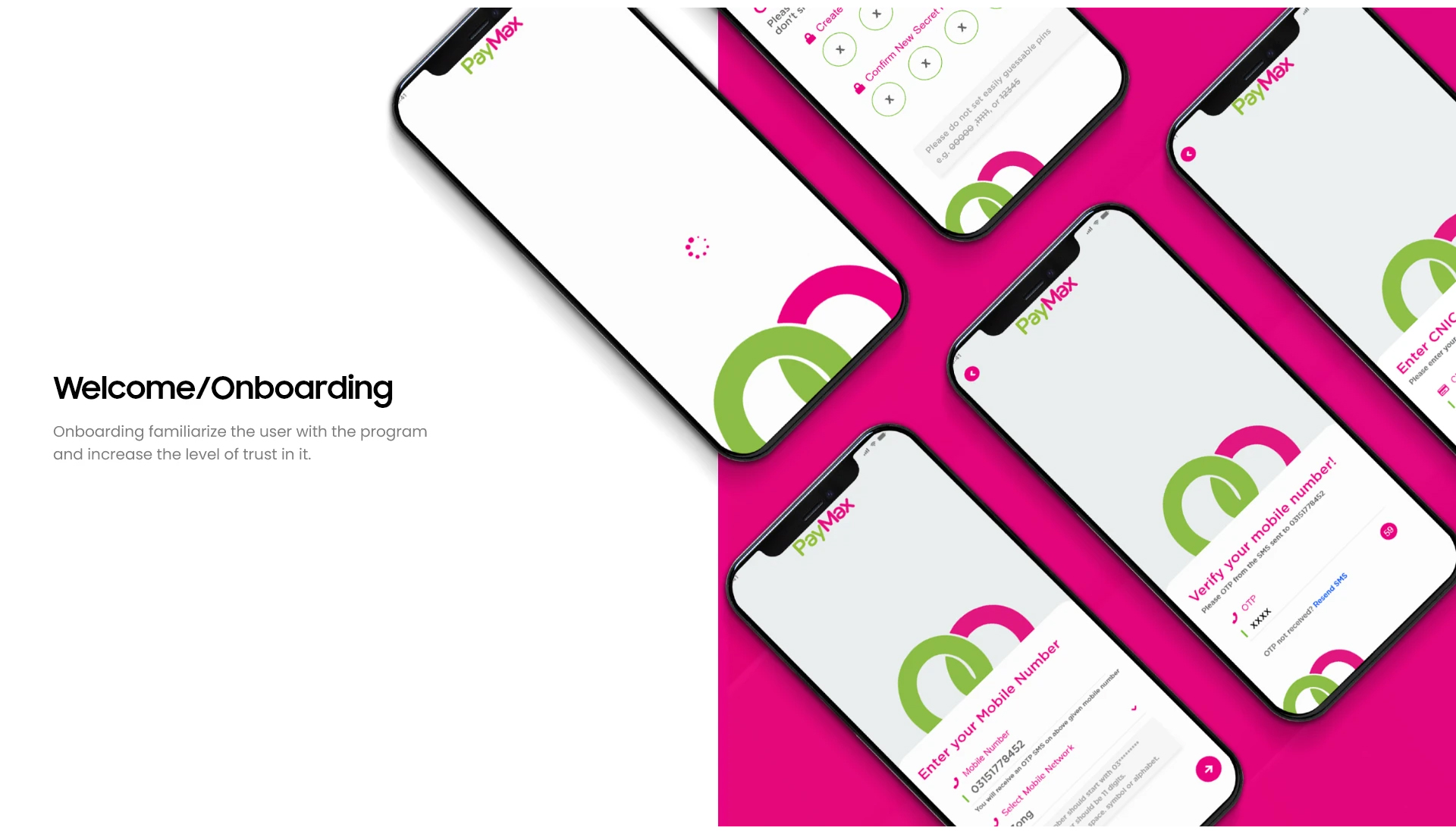

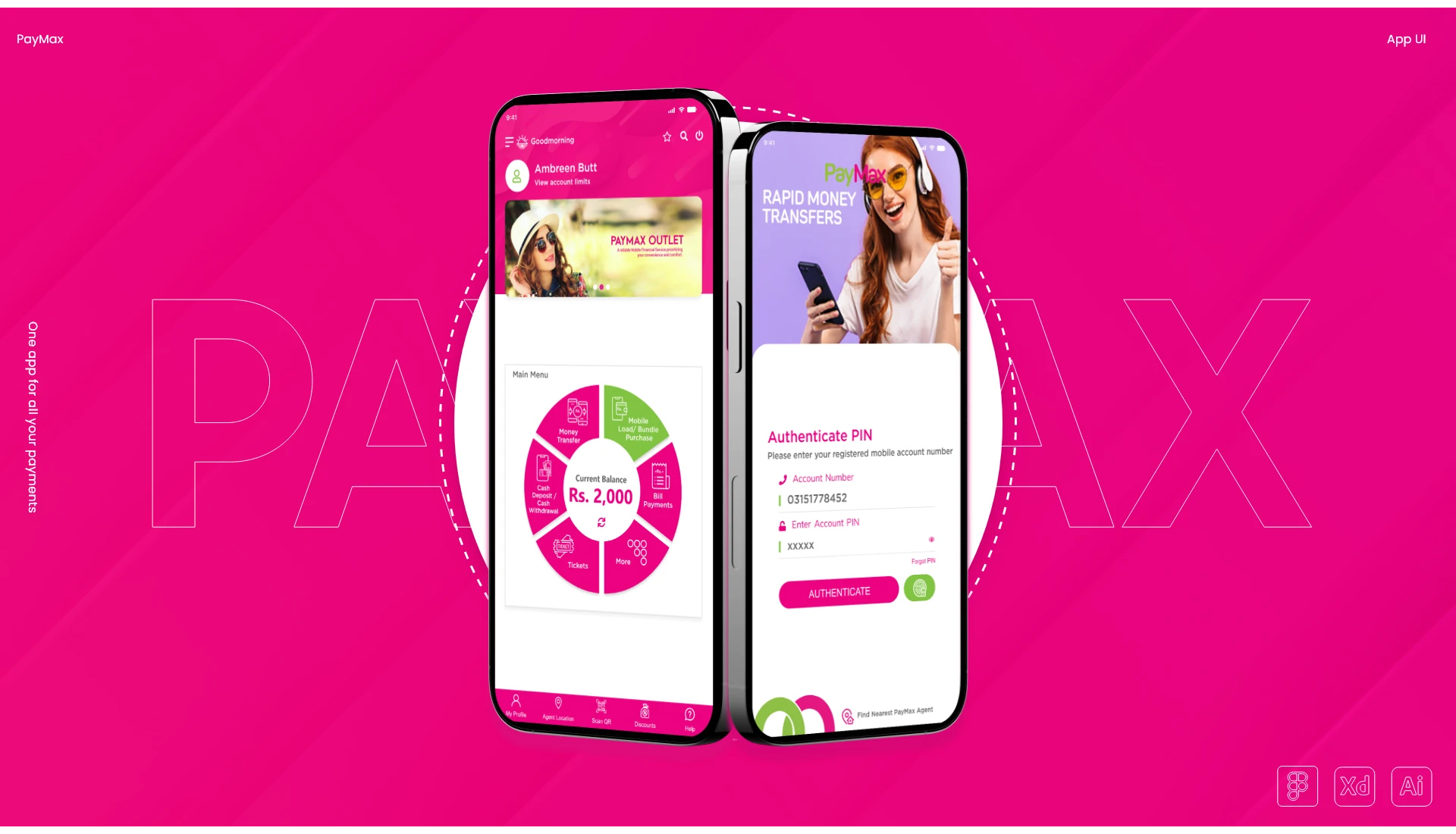

Paymax is a commercial digital payments solution launched by the Electronic Commerce Company Limited (ECCL), a wholly-owned subsidiary of CMPAK, the parent company of Zong. Positioned as a modern, secure, and reliable financial technology platform, Paymax aims to accelerate Pakistan’s shift from traditional cash-based transactions toward a fully digitized financial ecosystem.

| Phase | Timeline | Deliverables |

|---|---|---|

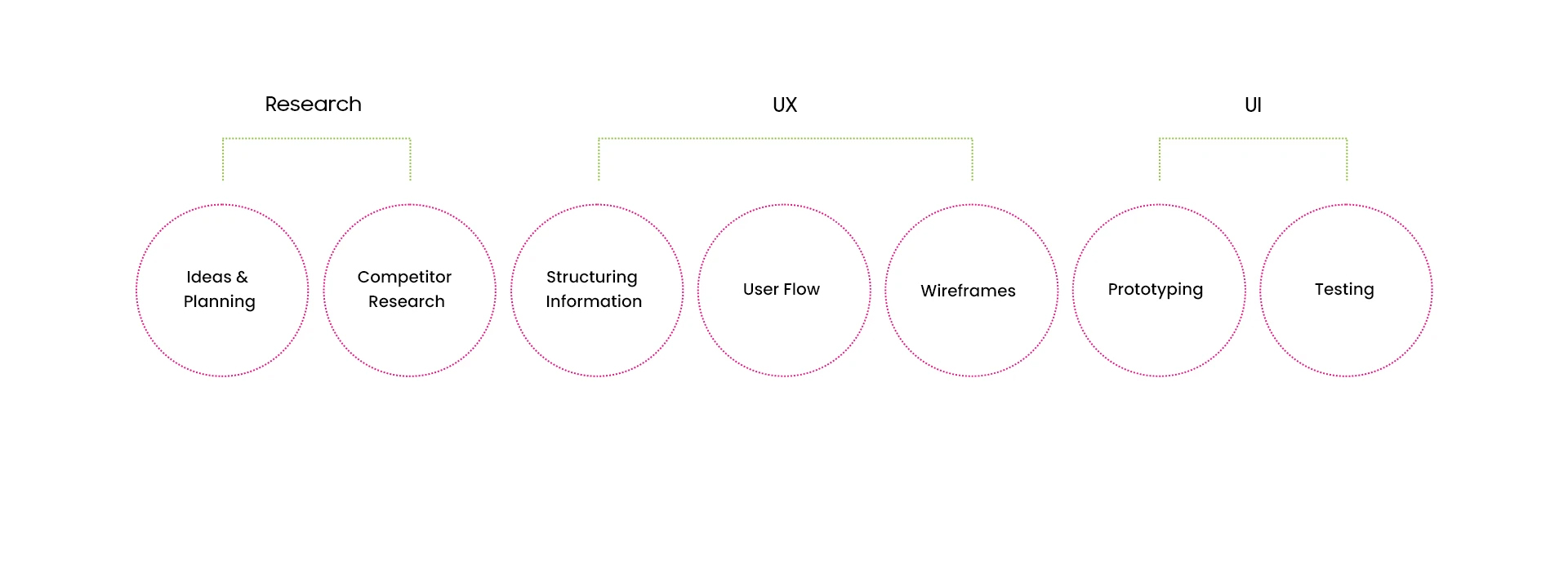

| Discovery & Research | 1–2 Weeks | User interviews, surveys, competitor analysis |

| Ideation & Wireframes | 2 Weeks | Lo-fi wireframes, feature prioritization |

| Visual Design | 3 Weeks | UI mockups, design system, feedback loops |

| Development Handoff | 3 Weeks | Figma files, design specs, prototype walkthrough |

| Testing & Iteration | 2 Weeks | Usability testing, iterations, final refinements |

Pakistan’s financial landscape has long relied on cash-based transactions, leading to:

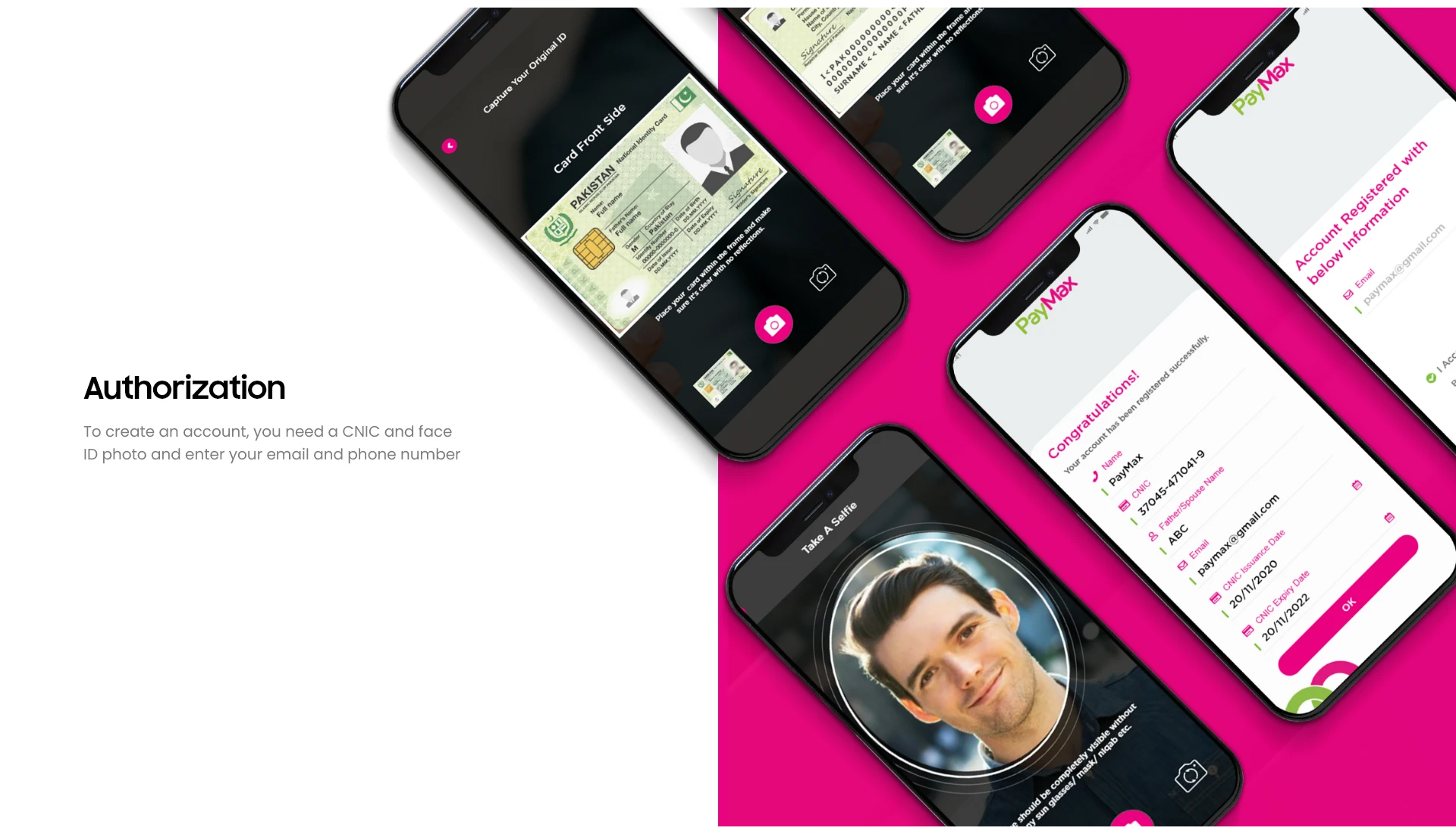

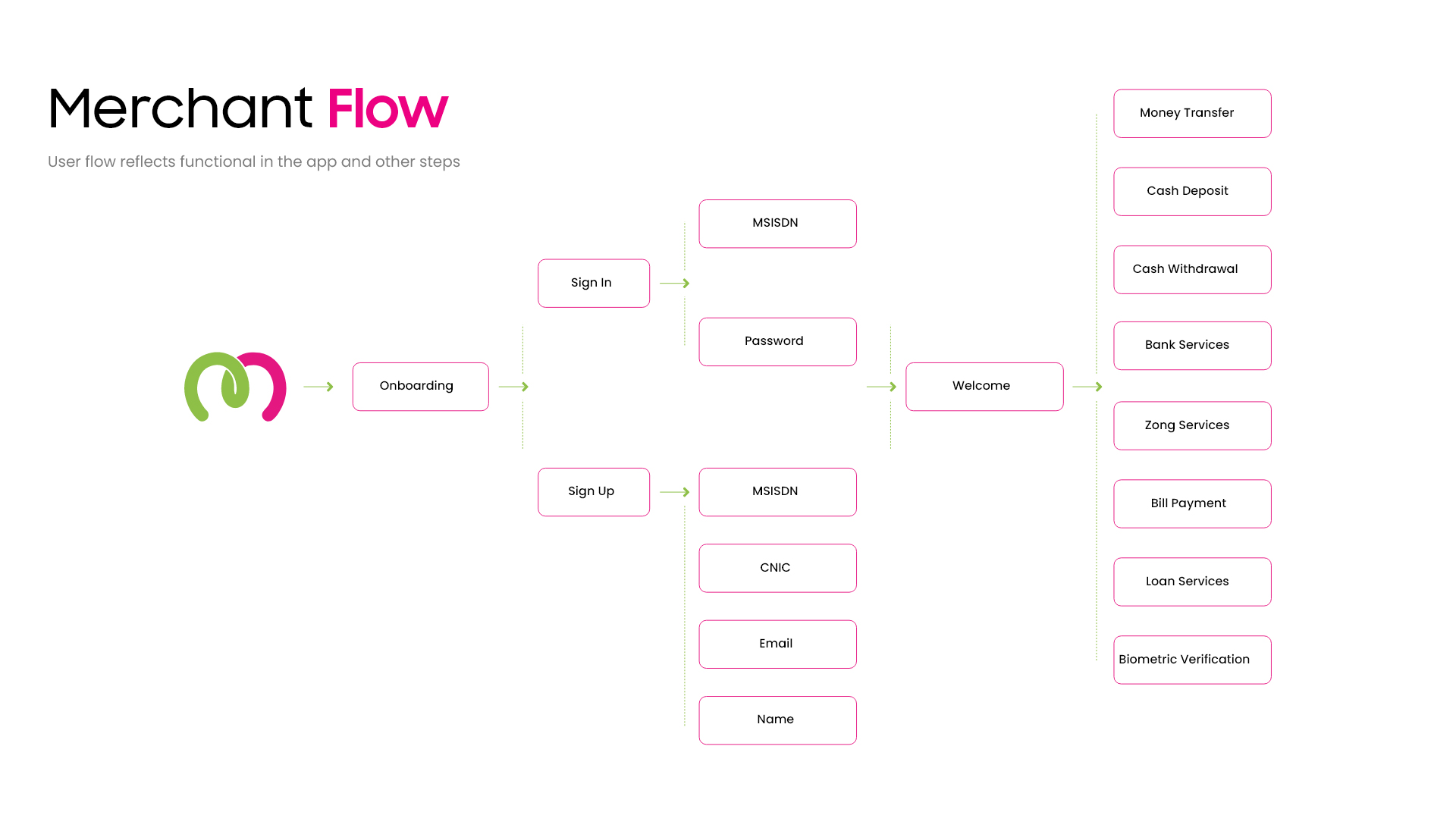

The challenge was to build a trusted digital payment platform that could integrate with banks, billers, and existing telecom infrastructure—offering reliability and convenience across the country.

Many Pakistanis faced common issues with existing financial services:

Users needed a single, secure, all-in-one platform for everyday payments.

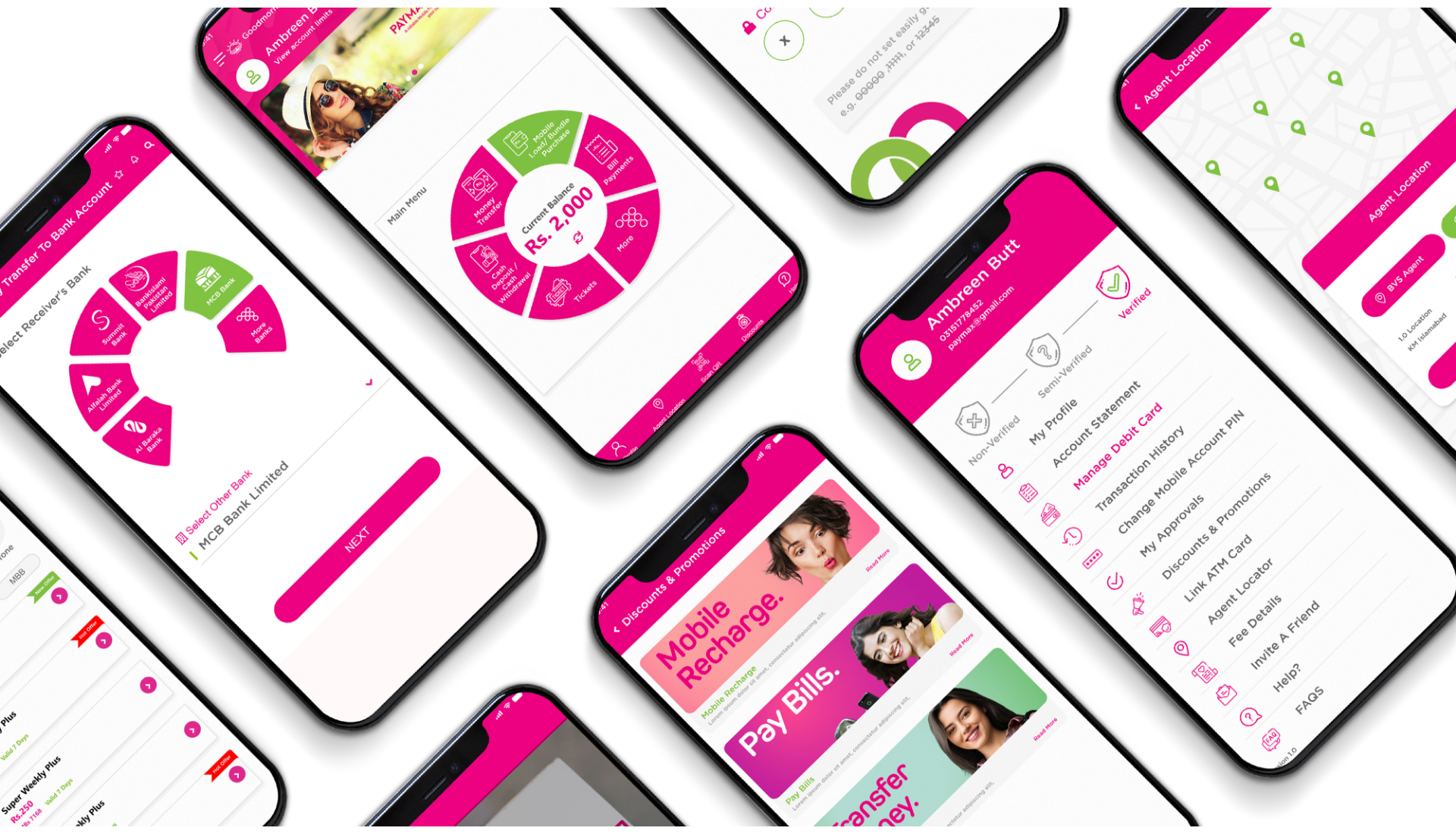

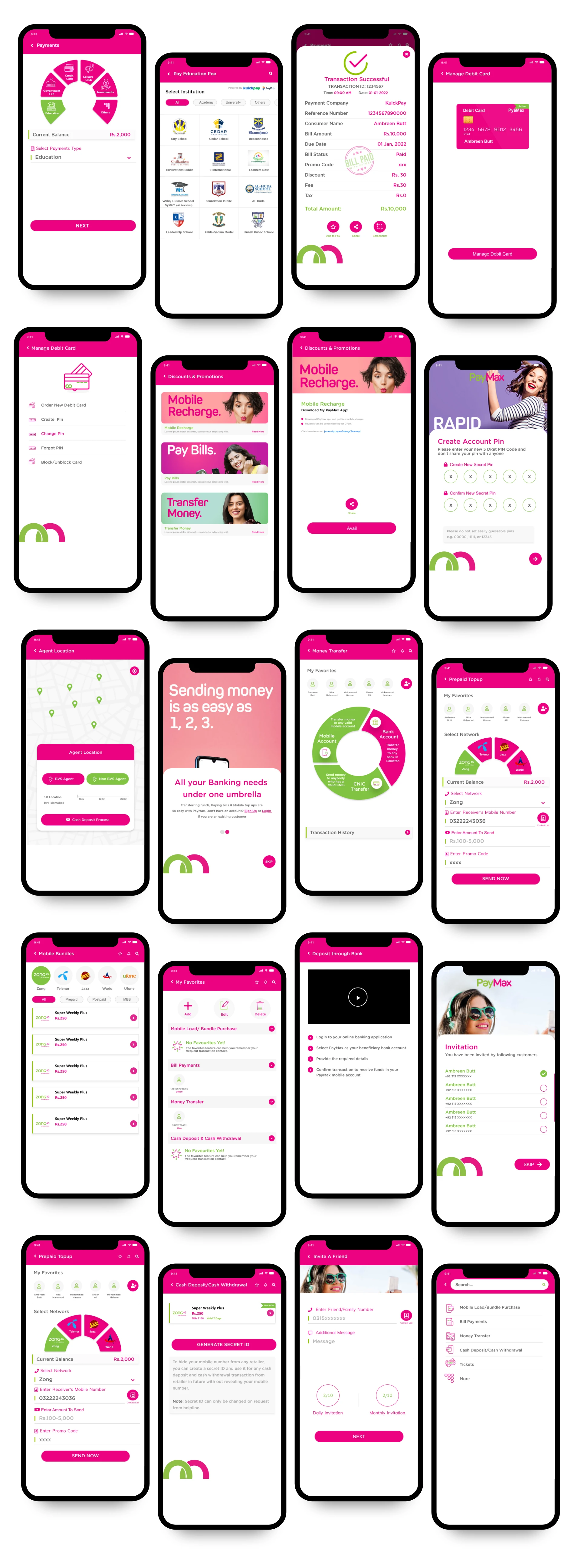

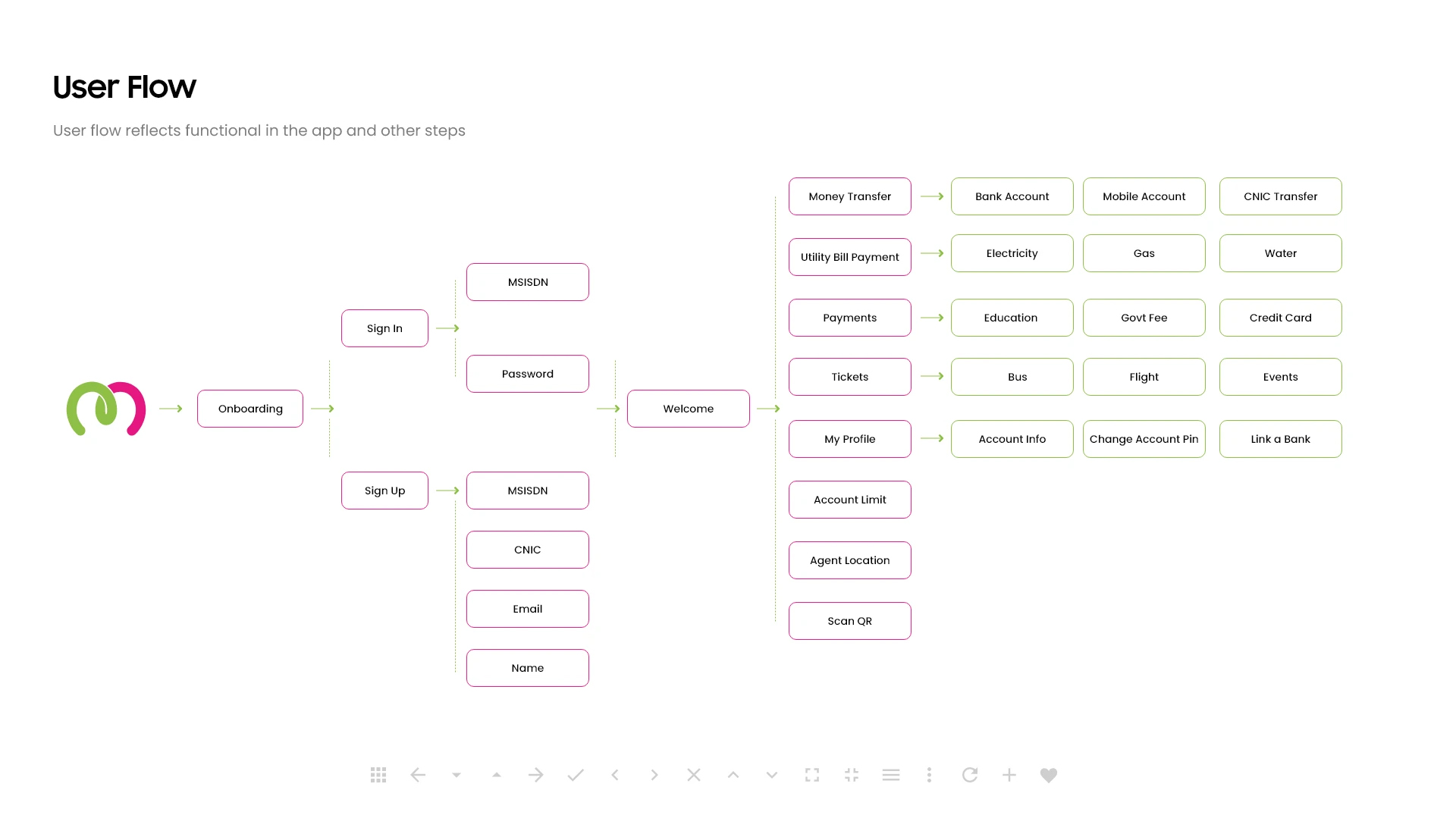

Paymax addressed these problems by offering a comprehensive digital payment ecosystem, including:

The solution empowered users by simplifying financial transactions and increasing digital trust.